How do I handle payroll and superannuation as a small business owner?

This guide will provide you with imperative insights on managing payroll and superannuation for your small business effectively. As a business owner, it’s your responsibility to ensure that your employees are paid accurately and on time, while also complying with superannuation regulations. In this post, you will learn practical strategies and tips to streamline your payroll processes and navigate superannuation requirements, empowering you to focus on growing your business while maintaining financial integrity.

Key Takeaways:

- Automate Processes: Utilize payroll software to simplify calculations and ensure compliance with legislation.

- Understand Obligations: Familiarize yourself with minimum wage laws and superannuation contributions to avoid penalties.

- Stay Organized: Keep detailed records of all payroll transactions and employee information for accurate reporting and audits.

Types of Payroll Systems

Before selecting a payroll system, consider your business needs and the complexity of your payroll. Here are various types of payroll systems:

- Manual Payroll

- Automated Payroll Solutions

- Outsourced Payroll Services

- Hybrid Payroll Systems

- Industry-Specific Payroll Systems

Thou should evaluate each to find the best fit for your situation.

| Manual Payroll | Relies on spreadsheets and written records. |

| Automated Payroll Solutions | Uses software to streamline payroll processing. |

| Outsourced Payroll Services | Delegates payroll tasks to third-party providers. |

| Hybrid Payroll Systems | Combines manual and automated approaches. |

| Industry-Specific Payroll Systems | Specializes in nuances of particular industries. |

Manual Payroll

Assuming you choose a manual payroll system, it involves calculating employee hours, deductions, and taxes by hand or with basic spreadsheets. While this method may save costs initially, it can be time-consuming and prone to errors, making it less ideal for growing businesses.

Automated Payroll Solutions

Little effort is required as automated payroll solutions can significantly streamline your payroll tasks, allowing you to focus on running your business. These systems typically offer features like automatic tax calculations and direct deposit for employees.

A comprehensive automated payroll solution includes user-friendly interfaces, integration with accounting software, and compliance updates for labor laws and tax regulations. By leveraging these systems, you can reduce manual work and minimize the risk of errors, leading to greater efficiency and accountability in your payroll management.

Understanding Superannuation

Assuming you are a small business owner, understanding superannuation is vital for ensuring your employees’ retirement savings are properly managed. Superannuation, or “super,” is a system of compulsory savings for employees, where you must contribute a percentage of their salary to their super fund. Keeping up with super obligations not only supports your staff’s future but also fosters a positive working environment.

Types of Superannuation Funds

Assuming you want to choose the right super fund for your employees, it’s necessary to understand the different types available.

- Retail Funds

- Industry Funds

- Corporate Funds

- Self-Managed Super Funds (SMSFs)

- Public Sector Funds

After selecting a suitable fund, you’ll be well on your way to fulfilling your superannuation responsibilities.

| Type of Fund | Description |

| Retail Funds | Often offered by banks, suitable for individual investors. |

| Industry Funds | Designed for specific industries, focusing on low fees. |

| Corporate Funds | Established by employers for their employees. |

| SMSFs | Allows you to manage your super fund yourself. |

| Public Sector Funds | Available to government employees, with specific terms. |

Legal Obligations for Employers

To stay compliant as a small business owner, it’s necessary to understand your legal obligations concerning superannuation. You must ensure that all eligible employees receive the appropriate super contributions, which are set at the minimum percentage of their earnings.

Understanding these legal obligations is necessary to avoid penalties and maintain a good relationship with your employees. You are required to contribute to the superannuation of eligible employees every quarter and must pay the superannuation guarantee (SG) charge if you fall short. Keeping up with these requirements helps you build trust and reliability in your business relationship, which ultimately leads to a healthier workplace environment.

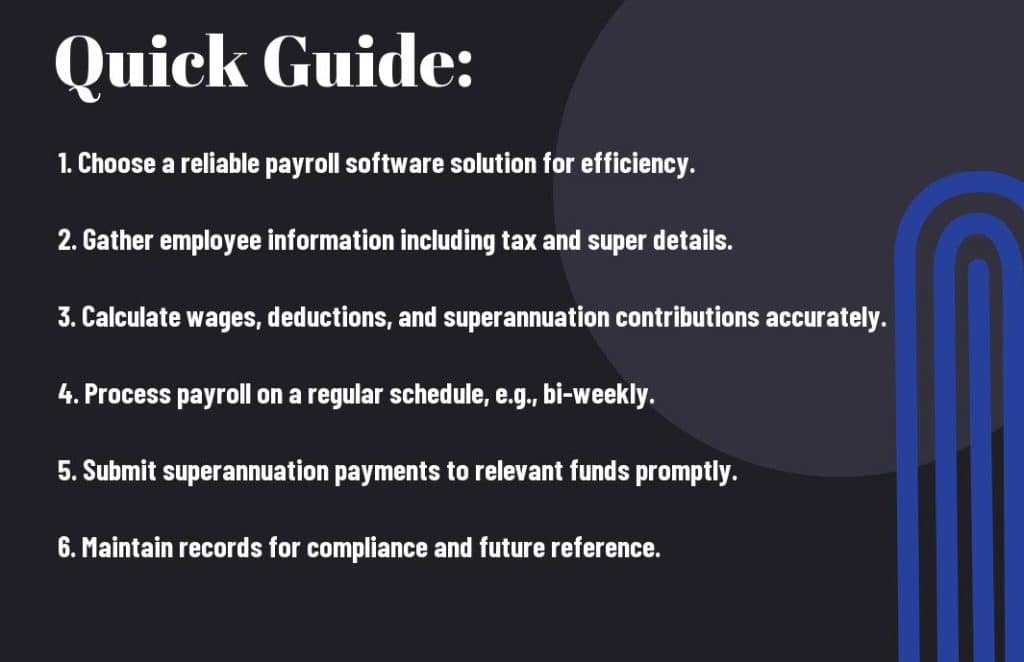

Step-by-Step Guide to Setting Up Payroll

Many small business owners find the payroll process overwhelming, but breaking it down into manageable steps can simplify the task. Follow this guide to set up payroll effectively:

| Step | Description |

|---|---|

| 1 | Gather employee information. |

| 2 | Choose a payroll schedule. |

| 3 | Select a payroll system. |

| 4 | Calculate wages and deductions. |

| 5 | Disburse payments and report taxes. |

Gathering Employee Information

Even before you can process payroll, you need to collect imperative information from your employees. This includes their full name, address, contact details, tax file number, and bank account information for direct deposits. Without accurate data, managing payroll becomes more complicated and prone to errors.

Choosing a Payroll Schedule

For your payroll to run smoothly, you should select a payroll schedule that fits your business and workforce. Common options include weekly, biweekly, or monthly pay periods. The choice you make can impact your cash flow and employee satisfaction.

Understanding your cash flow is key when choosing your payroll schedule. A weekly schedule may require more frequent cash outflows, while a monthly schedule could be easier for cash management. Consider your employees’ needs too; many prefer more frequent paychecks. Balancing both factors is important for a successful payroll setup.

Factors to Consider When Managing Payroll

Your approach to managing payroll involves several important factors that can affect your business’s financial stability and compliance. Consider the following elements:

- Your business structure

- Employee classifications

- Tax obligations

- Payroll technology

- Superannuation requirements

The effective management of these factors will help streamline your payroll process and ensure compliance with regulations.

Hiring Employees vs. Contractors

Assuming you are deciding between hiring employees and contractors, it’s necessary to weigh the pros and cons of each option. Employees typically provide more stability and loyalty, while contractors offer flexibility and reduced overhead costs. However, each classification carries different legal and tax implications that you need to understand before proceeding.

Business Growth and Payroll Scalability

Even as your business grows, it’s vital that your payroll system can scale to accommodate this expansion efficiently.

Consider how your payroll system can adapt to various growth scenarios, such as hiring more staff, increasing hours, or expanding your operations. You may want to invest in scalable payroll solutions that can accommodate fluctuating employee numbers and changing requirements. Updating your systems ahead of time will help to avoid potential bottlenecks in your operations as your team grows.

Tips for Effective Payroll Management

Once again, managing payroll effectively requires a strategic approach. Consider implementing these best practices:

- Utilize payroll software to streamline processes.

- Conduct regular audits for accuracy in payroll records.

- Set up a clear timeline for payroll processing.

- Communicate openly with employees regarding pay schedules.

- Stay organized by keeping thorough records and documentation.

Thou must establish routines to enhance efficiency and accuracy in your payroll management.

Regular Training for Staff

One of the keys to effective payroll management is providing regular training for your staff. This ensures that your team is well-versed in payroll processes, software usage, and compliance requirements. Ongoing training minimizes errors and builds confidence in managing responsibilities effectively.

Staying Updated with Legislation

Payroll management is also about staying updated with legislation affecting your business. Familiarizing yourself with changes in tax rates, superannuation requirements, and labor laws can help you avoid costly mistakes.

Management of payroll requires a commitment to ongoing education in regulatory changes. Keep informed about government updates and industry standards by subscribing to relevant newsletters or joining professional associations. Engage with legal advisors when necessary to ensure compliance. By taking these steps, you safeguard your business against penalties and enhance your credibility as an employer.

Pros and Cons of Different Payroll Options

To effectively manage payroll, you must weigh the pros and cons of the various options available to you. Below is a summary of these options:

| Pros | Cons |

|---|---|

| Cost-effective for small teams | Time-consuming administrative burden |

| Direct control over payroll processing | Potential for errors without software |

| Easy communication with your team | Lack of expertise in tax compliance |

| Customized processes for your business | Limited scalability for growth |

| Closer relationship with employees | High learning curve for software |

In-House vs. Outsourced Payroll

On one hand, managing payroll in-house gives you greater control and flexibility. You can tailor the process to meet your specific needs and maintain direct communication with your employees. On the other hand, outsourcing payroll can save you time and reduce the risk of errors, especially with complex regulations and compliance requirements.

Costs vs. Convenience

Assuming you consider both costs and convenience, it’s crucial to evaluate the trade-offs of each approach. While in-house payroll might seem more economical, it could demand considerable time and effort, particularly during peak business periods. In contrast, outsourcing can initially appear more expensive, but it often leads to long-term savings when you factor in the time saved and risk mitigation.

For instance, if you handle payroll internally, you may need to invest in specialized software and potentially hire additional staff, which can add up. Alternatively, when you choose to outsource, you can offload these tasks to experts who provide streamlined solutions and ensure compliance with regulations. This can significantly reduce stress and free you to focus on growing your business rather than getting bogged down in payroll details.

Summing up

As a reminder, managing payroll and superannuation as a small business owner requires a systematic approach. You need to ensure that you accurately track employee hours, calculate wages, and comply with tax obligations. Familiarize yourself with superannuation rates and deadlines to stay compliant. Consider using payroll software to simplify the process and maintain meticulous records. Regularly review your payroll practices to adapt to any changes in legislation or employee needs, ensuring you foster a healthy work environment while protecting your business interests.

Q: What are the key steps involved in managing payroll for my small business?

A: Managing payroll involves several necessary steps. First, you’ll need to establish a payroll system that suits your business needs, which could be manual or automated via payroll software. Next, you must gather and maintain accurate employee information, including hours worked, wages, and any deductions. It’s imperative to process payroll regularly, whether weekly, bi-weekly, or monthly, ensuring that all employees are paid on time. Additionally, you will need to calculate taxes, employee benefits, and any other contributions that may apply. After processing payroll, ensure all records are securely stored for compliance with legal requirements. Finally, stay updated on any changes to tax laws or employment regulations that could affect payroll.

Q: How do I manage superannuation contributions for my employees?

A: To manage superannuation contributions, begin by familiarizing yourself with the superannuation obligations in your region. In Australia, for example, employers must contribute a minimum percentage of their employees’ earnings to a super fund. Ensure you have valid superannuation fund details for each employee, which should be collected from them upon employment. You should then calculate the superannuation contribution based on their earnings, typically at the end of each pay period. Once calculated, promptly make the contributions to the appropriate super funds. It is also beneficial to keep accurate records of contributions made for each employee, as these documents may be required for reporting to the Australian Taxation Office (ATO) or for financial audits. Regularly review compliance with superannuation laws to avoid penalties.

Q: What tools or resources are available to assist with payroll and superannuation management?

A: There are various tools and resources available to help small business owners manage payroll and superannuation effectively. Cloud-based payroll software, such as Xero, MYOB, or QuickBooks, can simplify calculations, automate payments, and generate payslips and reports. For superannuation, many software platforms integrate with super funds, allowing for straightforward contributions management. Additionally, consulting with an accountant or payroll specialist can provide tailored advice and ensure compliance with current laws and regulations. Various online resources, including government websites, provide valuable information on payroll obligations and superannuation requirements. Furthermore, training courses or workshops on payroll management can also enhance your understanding and skills in this area.

Source article: https://smallbiztoolbox.com.au/how-do-i-handle-payroll-and-superannuation-as-a-small-business-owner/